I hope you are doing well and surfing the markets successfully. Today I have a round up on the latest news and updates in the crypto currency world (a lot is happening so a slightly longer update today).

Bitcoin & Ethereum Price Action

Governments globally continue to print record breaking and staggering amounts of money from thin air (quantitative easing) and devaluing cash on each occasion. The case for Bitcoin is clear and large global macro investors are increasingly adding Bitcoin to their portfolio.

On a high time frame basis, Bitcoin is in a large triangle formation and still deciding what it will do next. The key level to breach to the upside is $10k which would constitute a break of both the descending resistance and horizontal resistance and could easily spark a new bull trend (see chart No. 1 below).

On a shorter time frame basis, Bitcoin has been stuck in a horizontal range for the past 5 weeks (see chart No. 2 below). After the head fake I outlined in my last post, the price fell a bit and could easily fall from here.

If it does, then I will be a buyer in the low $8000’s as there is a strong confluence of buy indicators in the range including a) the RSI level approaching 30 b) 200 day moving average support c) horizontal support d) hidden bullish divergence building. From there we could easily break $10k.

Ethereum is largely tracking Bitcoin at present and all the above logic for Bitcoin also applies for ETH. I will be a buyer of Ethereum in the $180-200 zone.

Ethereum Fundamentals

I want to speak a bit about Ethereum. Everything I see/read/hear is making me more and more convinced that Ethereum has the best chance of being the worlds decentralised blockchain computer.

It’s a mammoth opportunity. The amount of apps, systems and tools being built on it is already staggering and more and more potential break through applications are being built all the time.

Stable coins like Tether are the first non-Bitcoin killer app for any blockchain application and I’ve discussed how excited I am about these way back when they were starting out. Stable coins now have a combined value of over $11 billion and are growing rapidly. The vast majority of this value is transacted on Ethereum and this is growing by the week. The way to make profit from stablecoins is by investing in Ethereum.

The second killer blockchain app I have talked about in the past is Security Tokens where any real world assets like gold, amazon shares, New York real estate, etc can be tokenised and distributed in an effective manner. These projects (e.g. POLY) are continuing to build with long term time frames. Most of the challenges are regulatory and liquidity. Once the regulatory issues are solved, this will be a huge market.

There is a third area where I see massive potential is DeFi (Decentralised Finance) and I will talk about this more in the months to come. This part of the crypto ecosystem is finally starting to come of age and having a real moment right now (read on for one of my top coin picks).

DeFi seeks to bring all the functions, products and systems of finance to a Person 2 Person marketplace, while cutting out the middlemen. This opportunity is enormous and the bulk of current and future DeFi apps are being built on Ethereum.

For example, a huge amount of money has been invested in Compound (COMP) which is an autonomous interest rate system built on the Ethereum blockchain that is made for developers building financial applications. What does that mean? Well in a nutshell, Compound lets you lend and borrow crypto assets without any middlemen. Lenders can earn interest, while borrowers deposit crypto to gain access to credit without the banking headaches or excessive fees. You can read more about it here and why it’s attracted huge money already.

In fact, the current market cap of DeFi is already over $6 billion. And underpinning all of these exciting developments and use cases is the Ethereum scaling progress.

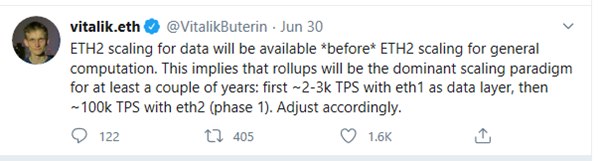

Vitalik Buterin, the Ethereum Creator, tweeted yesterday (see below) about rollups becoming more and more of an integral part of ETH 2.0. I spoke about this in the past and how it’s a breakthrough piece of the puzzle to achieve scaling to 100,000 transactions per second (TPS). A test net has been deployed for phase 1 of ETH 2.0 and progress is rumbling away in the background.

We need to have patience, but I expect if/when Ethereum starts to scale, we will be heading for the moon!

My Own Portfolio

My own Portfolio remains approx. 40% ETH, 40% BTC, 10% alt coins and 10% cash which I will use to buy any dips.

I am continuing to accumulate positions and buy any dips in a select group of alt coins which includes OGN, ALGO, XTZ, HBAR, POLY & NULS.

Most of these coins have achieved 100% (or much more since March).

I am also sometimes using the “sell half on a double strategy” and taking out my initial investment if/when a coin reaches 100% profit. I can retain the cash or redeploy this capital into another coin which looks good from a technical or fundamental perspective.

New Alt Coin Pick: Universal Market Access (UMA)

I have been watching the DeFi space closely and there are a few decent Projects competing to lead the pack. There is also a lot of nonsense project with shady founders, insider deals and general scammy projects in the space.

UMA is the former and a quality project and one of the top coins in the DeFi space. It is also built on Ethereum so by investing in Ethereum you also gain exposure to UMA and for every UMA transaction a small amount of ETH is needed.

UMA stands for Universal Market Access. It allows all sorts of decentralised financial applications to be created and used seamlessly.

Take something like derivatives. Traditionally, derivatives and other financial contracts are enforced through two mechanisms: (1) one party posts collateral as the value of the contract changes and (2) legal recourse, where one of the counterparties can sue if the other fails to uphold their contractual agreement.

In decentralized, permissionless systems like Ethereum however, legal recourse is fairly difficult as most users are pseudo-anonymous and the network operates on a global scale.

But with UMA’s framework, you create a trustless, permissionless mechanism that secures the contract by economic incentives alone. So you have an automatic, trustworthy system for executing contracts on all sorts of financial assets. It could be huge.

The main barriers to growth in my opinion will be regulatory, scalability and liquidity all which will take time but the promise and technology is there.

Once the technology is seen to work, then financial institutions and companies could flock to this network. In fact, I believe the Project itself is very robust and offers enormous potential to turn traditional finance on its head (albeit once regulatory hurdles are overcome).

However I do need to say that I have a significant reservation regarding the economics of the UMA coin itself. It is largely a governance coin: which means that it was set up so that a token holder gets to have a say in the governance of the project.

This system isn’t as good as a utility token like Ethereum where ETH needs to be spent each time a transaction occurs. I haven’t bought UMA myself just yet but am watching it closely and if/when I do make an acquisition it will be for a small amount of my portfolio for now (e.g. 1-2%). I’ll let you know when that happens.

You can find more information on UMA here….

News Roundup

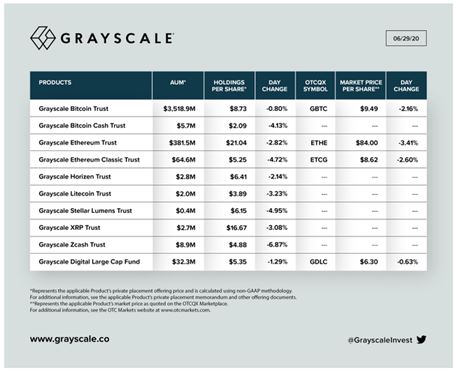

Institutional investors continue to enter the crypto markets with many buying the dip in March and Grayscale now buying up the equivalent of all mined Bitcoin and over $4 billion in assets under management (see table below).

In other news…

Paypal will now offer their platforms to buy crypto!

The stable coin USD Coin will now partly be run on ALGO which is a big coup for the Algorand Foundation and its token ALGO.

Pantera Capital had a very interesting take which I broadly agree with on the crypto space right now.

POLY continues to build and ship code and improve their platform.

Trading tip of the day

The worst way to trade is to enter trades based on FOMO (Fear Of missing Out) and exit trades based on Fear itself.

This is the main way that retail traders lose money. Cut these steps out of your trading game and build patience and you’ll take a massive step forward towards long term profitability.