Over the last week, there have been a number of discussions on the Facebook group about our ICO projects.

There were questions about Cappasity, about regulation…but mostly I think what we all want to know is: when are these investments going to pay off?

So in this update I thought I’d take a look at progress at each the ICOs we’ve looked at so far – Neufund, Copytrack, Cappasity, DID and TrustedHealth.

Many of these coins have not gained very much since we bought in – that’s the nature of getting in early on a high risk project with the potential for a big pay off.

The real spike in price will come as soon as a coin lists on a major exchange. That’s when we’ll see coins spike 1,000% to 2,000% and more. I’ll talk about when that might happen for our coins. And also what kind of regulatory risk we are dealing with.

In general, the regulatory arena has been very murky recently but I no longer think there will be a major clampdown by the SEC, and I believe there is a good chance that they will give many projects the opportunity to become compliant. That’s very good news for ICO investors. Let’s start by looking at Neufund…

Neufund (NEU) raised $10m in it’s funding round last December. Since then it’s project of building a new funding platform has shown some progress – the platform is apparently gearing up for launch, and companies will soon able to use it to raise funds.

Neufund has also teamed up with the Malta to help build a blockchain industry there. Here’s their latest update.

When will NEU list on a major exchange?

Neumark has listed on Liqui and HitBTC, but the big lift will come when it launches on a major exchange. Given that no US exchange has yet to list as a broker-dealer – with only Coinbase set to be close to this – I wouldn’t expect to see NEU on Poloniex, Bittrex or Kraken until after the platform is live.

This is in light of the SEC’s recent statement regarding Ethereum and ICO tokens in general. If the token is traded for only speculative purposes, it is a security. Once the app is live and the team is no longer crucial to its functioning, it may then be able to be traded outside of licensed venues. I therefore expect little movement on this token until the app is launched.

What about the risk of regulation?

Given the SEC’s recent statement, there is a slight risk of censure with this token since both HitBTC and Liqui allow US customers. That said, it’s clear that the SEC is allowing everyone become compliant before taking serious action. Europe, where Neufund is based, hasn’t looked like taking an aggressive strategy against projects that went with an ICO. All in all, I rate the risk of intervention as low currently but it’s certainly something to keep an eye on.

Potential return remains the same: I believe there is the potential for a five figure percentage return with this high risk punt.

Initial Token Price: £0.71

Price Now: £0.28

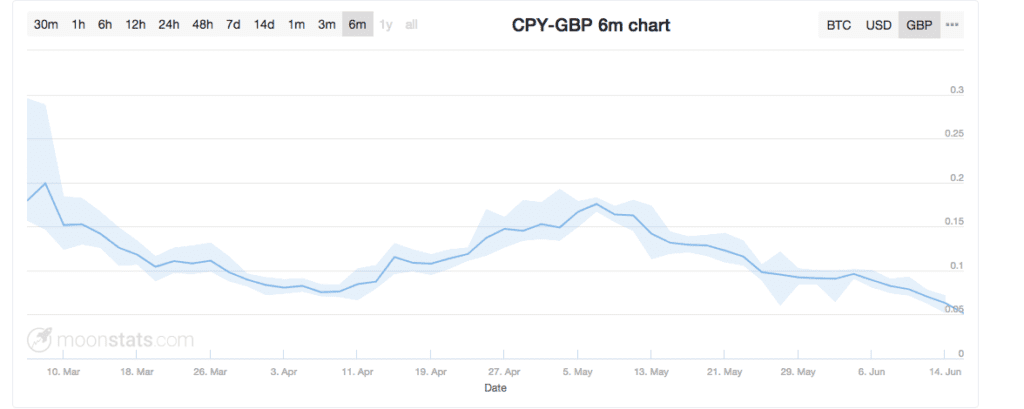

Not a huge amount of communication from this team of late, but Copytrack (CPY) says it is on course for an end of July launch of its Global Copyright Register. I’ll be keeping a close eye on this project.

With legal entities in Berlin and Singapore and presences in New York and Tokyo, CPY has already managed to gain considerable traction and is currently generating a claims volume of over €1.5 million per month.

The plan is to expand beyond copyright enforcement and create a marketplace for digital content. This article nails the potential of Copytrack – and why it might challenge Adobe, Getty and Shutterstock in managing image rights.

When will it list on a major exchange?

Since the SEC has been very clear that tokens that are traded solely for investment purposes without any functionality are securities, I wouldn’t expect this token to be listed on US exchanges until at least after its launch. KuCoin and Binance are ones to look out for in the meantime.

The risk of regulation?

Once an app has been launched, its token then has a good chance of no longer being designated a security and will be able to trade freely outside of licensed venues.Copytrack appears to be taking a conservative approach – very sensible. Once their app is ready, they should be able to launch with little fear of regulatory intervention.

Potential return remains the same: I believe there is the potential for a five figure percentage return with this high risk punt.

Initial Token Price: £0.16

Price Now: £0.06

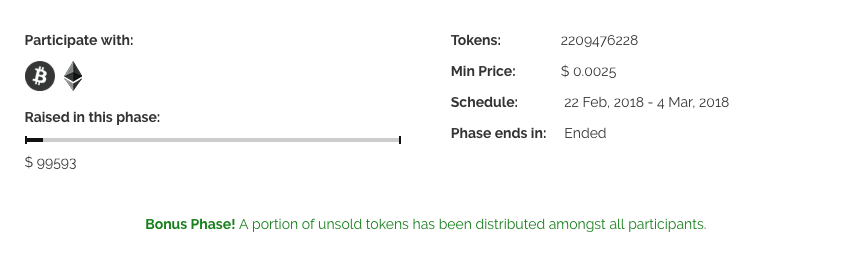

This is our play on identity protection. Decentralised ID (DID) did not raise the funds it was hoping for in the latest rounds (see the phase summary below) but it has a good team, a decent use case for blockchain and plans to plough ahead with it’s Foundation for identity protection.

I would like to see a lot more progress with this project. Their communications appear a little empty with promises of “things around the corner” and little substance to go on. Hoping to see a lot more concrete developments from this project.

When will DID list on a major exchange?

DID claim they have started this process in April and have been in contact with five exchanges to negotiate terms. I’ll see how this develops. Again, as I keep saying, I believe their success will largely hinge on them getting a working product in place first. The SEC has been clear on its criteria.

The risk of regulation: Since the token hasn’t listed anywhere and the team KYC’dits ICO participants, the risk of regulatory intervention on this project is currently low.

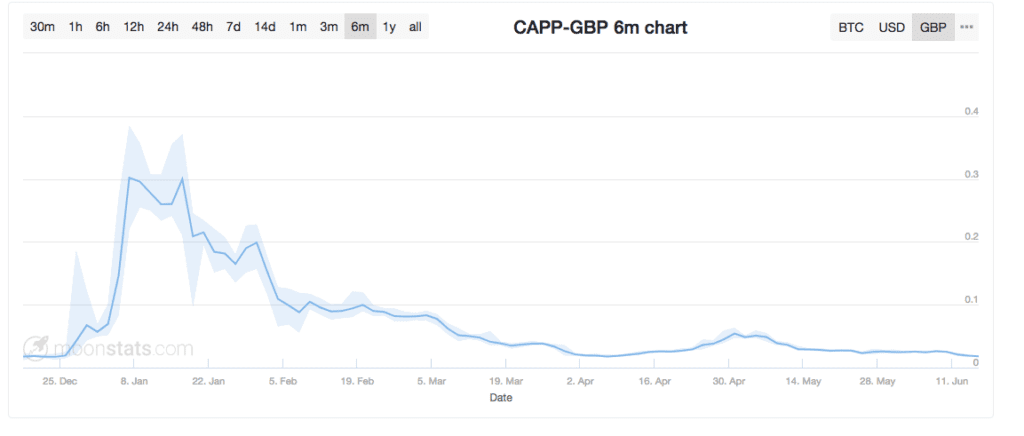

Cappasity (CAPP) is a platform for buying/renting/selling VR content on the blockchain – a story l like. 3D technologies are already becoming a big part of retail and shopping online. People who click on 3D images of products are far more likely to make a purchase. CAP is preparing to launch its 3D capturing app. There is also a potential partnership with LVMH in the offing. Big potential here.

The team gives regular insightful updates to stakeholders on its Medium blog with its latest post here

When will CAPP list on a major exchange?

CAPP is thinly traded on the KuCoin exchange but there is no indication of when they might launch on a significant exchange. I suspect we won’t see the token on any of the US exchanges until its app has launched given the SEC’s recent statement.

The risk of regulation?

Since it is currently trading on KuCoin ahead of product launch there is some risk here. There is some risk the team (and KuCoin) could be reprimanded. That said, it is more likely that the US will allow both parties to become compliant as long as they’re not engaging in outright fraud. The team also implemented proper KYC protocols which is another good thing for keeping the regulator off your back.

Potential return remains the same: I believe there is the potential for a five figure percentage return with this high risk punt. There is a slightly heightened regulatory risk with this one too.

Price in ICO: £0.027

Price now: £0.017

TrustedHealth (TDH) is designed to be a decentralised patient- and doctor-driven cooperative focused on life-threatening or rare diseases. The idea is you get speedy consultations and the company also wants to make it easier to obtain second opinions, with research published in the Journal of Evaluation in Clinical Practice revealing up to 88 percent of patients who saw a second doctor during a Mayo Clinic study were presented with a refined or completely new diagnosis.

The company is partnering with the existing Trustedoctor platform which is well established. I like the team behind it and they have the back of the World Health Organisation.

Trusted Health raised approximately $1.25m this year. They appear to be making good progress and have been hitting milestones outlined on their roadmap. The next big milestone is the implementation of the TDH token into the Trustedoctor platform.

The team are good with comms which is always a good thing from the point of view of an investor. Here’s their latest update.

When will TDH list on a major exchange?

Since token implementation isn’t due until Q4 of this year and since the SEC has been very clear that tokens that are traded solely for investment purposes without any functionality are securities, I wouldn’t expect this token to be listed on exchanges until at least Q4 of this year and most likely later.

What about the risk of regulation?

Trusted Health implemented proper KYC protocols on their sale and haven’t released any tokens pre-launch so I wouldn’t expect them to be a risky bet for regulatory intervention. This, of course, is one of the main reasons I recommended them. As long as they wait until their system is live and functioning they should he fine in light of the SEC’s position on Ethereum.

Potential return remains the same: I believe there is the potential for a five figure percentage return with this high risk punt. One thing I’m confident on is that the risk is entirely market derived with regulatory risk now fading.

That’s all for now. Keep an eye out of the webinars over the coming weeks for ongoing updates.

Until then,

Finn

The Crypto Traders’ Academy Team